Explain Different Type of International Financial Market Instruments

Features of Money Market Instruments. But the money market transactions cant.

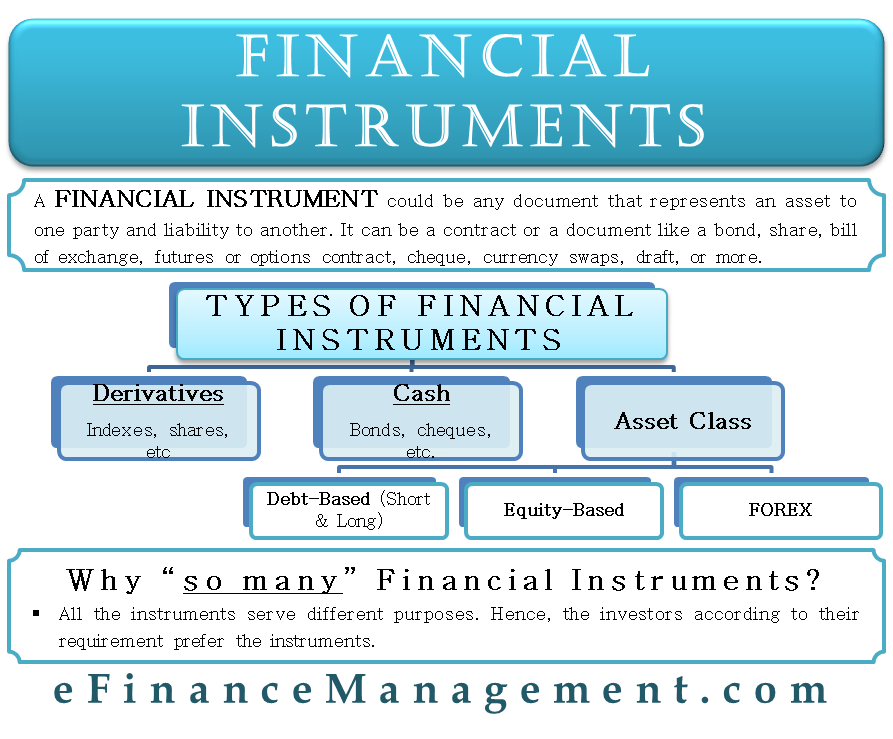

Financial Instrument Definition Types Example Of Financial Instruments

Money market is a part of a larger financial market which consists of numerous smaller sub-markets like bill market acceptance market call money market etc.

. Stocks and bonds are the most traditional types of financial instruments although there are sophisticated ways to invest in these securities. When an investor purchases stock he or she is obtaining an equity stake in that corporate entity that entitles him. Besides the money market deals are not out in money cash but other instruments like trade bills government papers promissory notes etc.

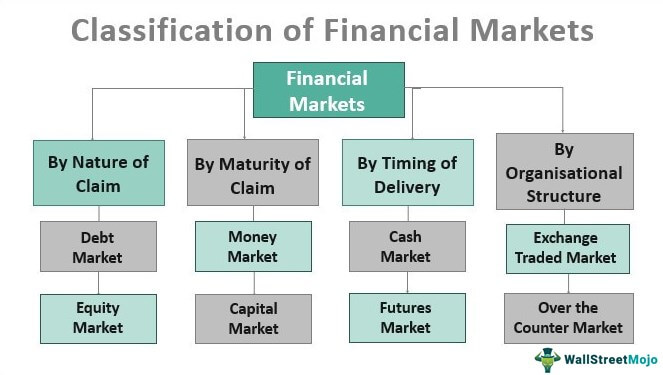

Money market instruments are short-term financing instruments aiming to increase the financial liquidity of businesses. Different types of money market instruments. Stocks bonds derivatives forex commodities and cryptocurrency markets are some of the types of the financial market.

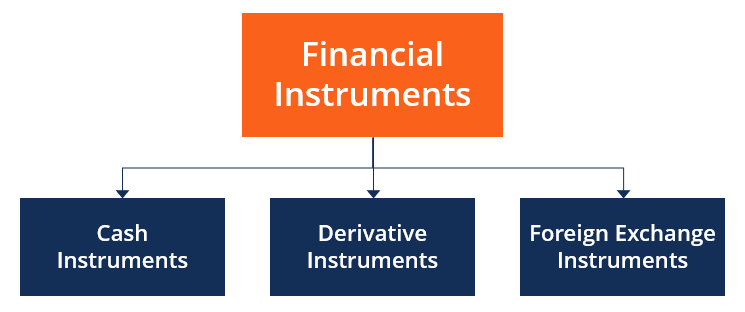

Foreign exchange instruments are financial instruments represented on the foreign market. Derivative Instruments and Cash Instruments. To one organization and as a liability to another organization and these solely taken into use for trading purposes.

A American Depository Receipts ADRs This a tool often used for international financing. They generate fixed-income for the investor and short term maturity make them highly liquid. Cash Instruments The values of cash instruments are directly influenced and determined by the markets.

GLOBAL DEPOSITORY RECEIPTS GDRs. International Money Market 5. A financial market is a word that describes a marketplace where bonds equity securities currencies are traded.

One of the key features of these financial assets is high liquidity offered by them. Cash instruments and derivative instruments. The financial instruments used for this purpose are.

A third application of the new methodology has been to investigate the increasing participation of emerging market economies in international financial marketsRecent experience for many emerging countries shows that the change in. It is an important segment of the international financial markets. How Do Financial Markets Work.

As the name suggests depository receipts issued by a company in the USA are known as American Depository Receipts. Many of these instruments of the money market are part of the US. The main among them include International Finance Corporation IFC EXIM Bank and Asian Development Bank.

A financial market is a platform where businesses and investors look forward to raising funds to grow their ventures and reap good returns on investments. Or in simple words these instruments are securities that we link to other securities. Sutherland in Handbook of Safeguarding Global Financial Stability 2013 Global Imbalances and Emerging Market Portfolios.

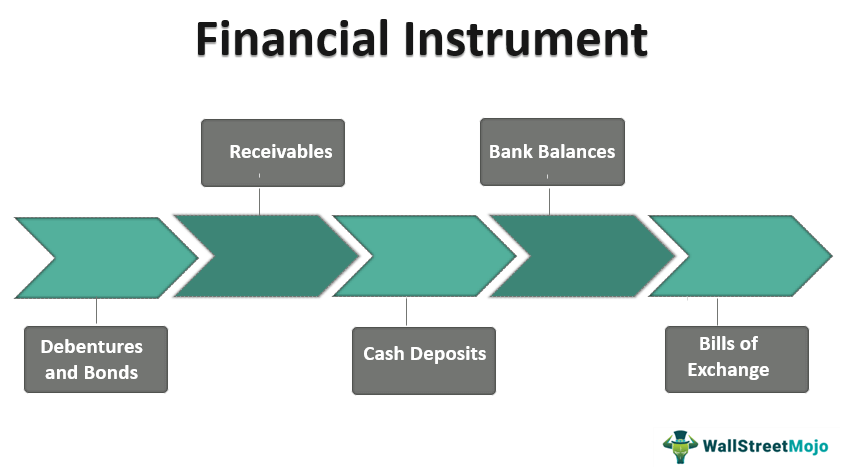

It mainly consists of currency agreements and derivatives. Hedge funds are designed to generate returns that exceed those of the broader markets. Financial instruments are certain contracts or any document that acts as financial assets such as debentures and bonds receivables cash deposits bank balances swaps cap futures shares bills of exchange forwards FRA or forward rate agreement etc.

There are mainly two types of financial instruments. Lets get started today. They are considered the safest among the money market instruments in India.

Foreign Exchange Market 2. Types of Financial Instruments. Ad Were all about helping you get more from your money.

ADRs can be bought and sold in American markets like regular stocks. Treasury bills T-Bills Treasury bills or T-Bills are issued by the Indian Government to fulfill its short-term obligations. Based on currency agreements they can be broken into three categories ie.

Financial instruments may be divided into two types. International Credit Market 6. These are markets where businesses grow their cash companies decrease risks and investors make more cash.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Foreign exchange market is the market for the purchase and sale of foreign currencies. The money market and its instruments are usually traded over the.

International financial markets consist of mainly international banking services and international money markets. Several types of money market instruments are available to be traded. Prominent international financial instruments used by various companies are.

International Bond Market 3. They include currency check deposits as well as money market funds certificates of deposit and savings accounts. We derive the value of such instruments from the value and characteristics of the asset they represent.

International Equity Market 4. The banking services include the services such as trade financing foreign exchange foreign investment hedging instruments such as forwards and options etc. Owing to this characteristic money market instruments are considered as close substitutes of money.

The main characteristic of these kinds of securities is that they can be converted to cash with ease thereby preserving the cash requirements of an investor. International banks provide all these banking services. A few of these are given below.

Few financial markets do a security business of trillions of dollars daily and some are small-scale with less activity. The size of the money supply affects interest rates consequently influencing economic growth.

Financial Instrument Overview Types Asset Classes

Financial Instruments What It Is Types And More

Financial Markets Functions Importance And Types

Classification Of Financial Markets 4 Ways To Classify Financial Markets

Comments

Post a Comment